Variations around the skills mix in care homes

Care homes for older people

The Care Inspectorate is aware of the challenges faced by some care providers on the recruitment and retention of nurses in the care sector. Some care providers have approached us about reconfiguring their staffing model, to develop the role of their senior care workers so that they can deploy their nurses more effectively and in some cases reduce reliance on agency nursing in order to promote more stable staff teams.

The Care Inspectorate recognises and strongly supports the role that nurses play in many care homes, particularly in providing clinical leadership and planning care for residents. We are also keen to support innovation in care that reflects changing needs and demands, where this improves outcomes for service users.

Where care homes for older people are proposing to vary the skills mix in a care home, and this would require a change to staffing schedules, we will consider proposals through our registration variations process. We expect such proposals to improve the quality of care for residents. We will ask care homes to provide us with specific information to support the variation request.

If agreed, we may place specific time-limited conditions on the registration of the service. We will expect any such initiative to be evaluated by the care home provider, before consideration is given to confirming these arrangements as permanent. Where a variation is agreed, the next inspection of the care home is likely to look at all quality themes, even if the home has been performing at a high level for some time.

Prior to submitting your variation, the registration team will be able to advise on what actions you should be taking to support your application. This should include engagement with local commissioners, as well as with residents and relatives and the development of a plan to evaluate the impact and effectiveness of your initiative. Please note, cost saving will not be an acceptable reason for application.

Read more

Care...about physical activity

The Care Inspectorate’s Care about Physical Activity (CAPA) programme ran from April 2017 to May 2020.

CAPA used an improvement approach to help care providers build physical activity and more movement into the daily lives of those they support. Sometimes within hospitals and care settings and even in our own homes, older people can get out of the habit of moving. This has negative consequences. Prolonged sitting leads to poor health such as frailty, falls and bone health. It also results in a poorer quality of life, depression and loneliness.

Moving more often during the day is of crucial importance to older people’s health and wellbeing. Increasing strength and balance in particular also helps older people to remain independent for longer, have a better quality of life and contributes to reduced falls.

A report, including detail, stories and information from the programme, can be accessed here.

Managers and staff who work with older people from:

*Care at Home *Day Care *Care Homes

*Sheltered Housing *Very sheltered housing *Respite care

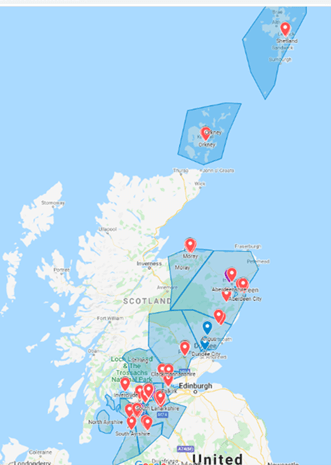

across 19 Health & Social Care Partnership areas were involved with the CAPA programme (see map below)

Care professionals of all levels, local inspectors, designated partnership leads, integration leads, community and leisure groups and others came together at a variety of learning events (see red tags on the map). Those present were supported to understand how movement contributes to positive health and wellbeing.

Participants were supported to translate this understanding into developing their own movement ideas in their own settings with the people they knew well. Principles of Community Connection, Organisational Culture and Physical Activity Participation were examined from the viewpoint of each service.

For example, how could residents in a care home connect with others in their community in an area of interest.

Some services used an established battery of physical and psychological tests/ questionnaires to track improvement and to contribute this data to the overall evaluation of the programme.

The CAPA programme complemented the work of adult service inspectors who support services to provide high quality care and support that is right for each person as part of their scrutiny and improvement role.

Independent research commissioned by the Care Inspectorate investigated psychological and physiological impacts of moving more often. The first phase evaluation found that older people involved in the programme have significantly improved their hand grip strength, their low leg strength, gradually increased their flexibility which improved mobility and levels of independence and significantly reduced their likelihood of falls as a result of moving more. People also experienced greater life satisfaction and felt less anxious.

Case studies

Click on the selection of short films below showing what happened when care professionals found ways to promote more movement for those they support. These films can be used in team meetings or viewed by staff who are interested in finding new ideas to improve health and wellbeing.

Margaret's story (Care at Home)

Jacqui, a home carer, talks about how promoting movement is not as time consuming as they originally thought and how they are helping people receiving care at home to incorporate moving more into their daily lives

Jean's story (Day Care)

See how day care centre staff supported Jean to get out of her wheelchair. Jean started to walk, became more active, enjoyed increased energy levels and took up hobbies and passions.

Beth's story (Care Home)

Show this short film to spark discussion at team meetings. Listen to how Beth's quality of life improved when care home staff started something small.

Daphne's story (Care Home)

Care Home staff help Daphne incorporate more movement into her day which improves her health and wellbeing. Daphne’s son talks about the differences he has seen.

Care...about physical activity resources

We developed many resources together with care professionals and people experiencing care. Here is a selection that you might find useful:

'Make Every Move Count' pocket guide which helps staff understand that movement is about the small, simple things we can add into daily life that make a big difference to people experiencing care.

'Moving More Often' pocket guide. People living in their own homes have found these useful to identify what is important to them, give support to move more often every day, promote independence and the possibility of continuing to live at home.

Information for relatives This short factsheet encourages relatives and friends to support their older relative to move more often for positive health and wellbeing. Some services have found it useful to include this information in care plans, introductory packs or newsletters

My moving more improvement record People experiencing care use this to track their improvement over time. People have found this personal record motivating to use themselves, and a useful way to involve family and friends.

'Care...about physical activity' booklet outlines the original CAPA resource developed for care homes

More information and good practice stories can be found by searching further in the HUB

- Go to your area of interest (e.g. Adults & Older People), then e.g. Care Homes for adults.

Under Topics choose ‘Type - creative and physical activity ‘, or ‘Resources - case studies’ to pull up resources including films that you might find useful.

Read more

Evaluations (grades)

We will provide an overall evaluation for each of the key questions we inspect, using the six-point scale from unsatisfactory (1) to excellent (6). This will be taken from the specific quality indicators that we inspect.

The evaluations for each set of quality indicators within the key question will inform an overall evaluation (using the same scale) for that particular key question. key question the indicators sit under.

Where we inspect only one of the quality indicators under a key question, the evaluation we give the indicator will automatically be the evaluation for the key question overall. Where we inspect more than one quality indicator per key question, the overall evaluation for the key question will be the lowest evaluation (grade) of the quality indicators for that specific key question.

For example, if we evaluate only one quality indicator under key question two, as ‘very good’ then the overall evaluation for key question two will be ‘very good’. However, if we evaluate three quality indicators under key question two as ‘good’, ‘adequate’, and ‘good’ respectively, the overall evaluation for the key question will be ‘adequate’. This indicates that there is a key element of practice that makes the overall key question no better than the lowest evaluation (grade).

The six-point scale

We use the six-point scale to describe the quality we see:

| 6 | Excellent | Outstanding or sector leading |

| 5 | Very good | Major strengths |

| 4 | Good | Important strengths, with some areas for improvement |

| 3 | Adequate | Strengths just outweigh weaknesses |

| 2 | Weak | Important weaknesses - priority action required |

| 1 | Unsatisfactory | Major weaknesses - urgent remedial action required |

An evaluation of excellent describes performance which is sector leading and supports experiences and outcomes for people which are of outstandingly high quality. There is a demonstrable track record of innovative, effective practice and/or very high-quality performance across a wide range of its activities and from which others could learn. We can be confident that excellent performance is sustainable and that it will be maintained.

An evaluation of very good will apply to performance that demonstrates major strengths in supporting positive outcomes for people. There are very few areas for improvement. Those that do exist will have minimal adverse impact on people’s experiences and outcomes. While opportunities are taken to strive for excellence within a culture of continuous improvement, performance evaluated as very good does not require significant adjustment.

An evaluation of good applies to performance where there is a number of important strengths which, taken together, clearly outweigh areas for improvement. The strengths will have a significant positive impact on people’s experiences and outcomes. However, improvements are required to maximise wellbeing and ensure that people consistently have experiences and outcomes which are as positive as possible.

An evaluation of adequate applies where there are some strengths but these just outweigh weaknesses. Strengths may still have a positive impact but the likelihood of achieving positive experiences and outcomes for people is reduced significantly because key areas of performance need to improve. Performance which is evaluated as adequate may be tolerable in particular circumstances, such as where a service or partnership is not yet fully established, or in the midst of major transition. However, continued performance at adequate level is not acceptable. Improvements must be made by building on strengths while addressing those elements that are not contributing to positive experiences and outcomes for people.

An evaluation of weak will apply to performance in which strengths can be identified but these are outweighed or compromised by significant weaknesses. The weaknesses, either individually or when added together, substantially affect peoples’ experiences or outcomes. Without improvement as a matter of priority, the welfare or safety of people may be compromised, or their critical needs not met. Weak performance requires action in the form of structured and planned improvement by the provider or partnership with a mechanism to demonstrate clearly that sustainable improvements have been made.

An evaluation of unsatisfactory will apply when there are major weaknesses in critical aspects of performance which require immediate remedial action to improve experiences and outcomes for people. It is likely that people’s welfare or safety will be compromised by risks which cannot be tolerated. Those accountable for carrying out the necessary actions for improvement must do so as a matter of urgency, to ensure that people are protected, and their wellbeing improves without delay.

While we have clarified what we mean by each evaluation to ensure a better, shared understanding of these, our evaluation scale from one to six has not changed. This is because in the 100 test inspections we carried out, there were no significant issues that indicated a change was needed.

The Health and Social Care Standards published by the Scottish Government in 2017, significantly modernise the expectations of what people should experience from their care and support. We must, by law, take these into account when making decisions on our inspections.

Read more

Promoting continence for people living with dementia and long term conditions

This resource highlights the fundamental and essential care and support required to give people the opportunity to remain continent and maximise their quality of life.

Its production involved people living with dementia and their families and carers as well as staff from across the health and social care sector.The resource can be used by people living with dementia and their families as part of self-management as well as by staff working across health and social care.

The resource, which was piloted across NHS assessment units, care homes, day centres and care at home services, can be used by people to manage their own continence as well as by carers, both formal and informal, in a wide variety of settings.

It contains an easy read guide, poster and DVD to support its five key messages which are:

- Know me and what’s important in my life and do what’s best for me.

- Know me and how I communicate.

- What I need to stay continent and how you can help.

- Create an environment that supports me to be independent and promotes continence.

- Look for every opportunity to promote my continence – be creative.

The project was led by the Care Inspectorate and delivered in partnership with Scottish Care, Scottish Government, NHS Continence Advisers, the Scottish Dementia Working Group, ACA and the National Dementia Carers Action Network (NDCAN).

For copies of the resource call 0345 600 9527.

Read more

Register a care service (other than childminding)

Care services in Scotland must, by law, register with the Care Inspectorate.

We regulate care services using the Health and Social Care Standards and the Public Services Reform (Scotland) Act 2010.

Click here to see the definitions of the care services that must be registered with us.

Before you register a care service you should read:

- Guidance for applicants on applying to register a care service

- Guidance for providers and applicants on aims and objectives

- Guidance for providers on the registration of dispersed services

- Our quality framework relevant to your service type

- Self-evaluation for improvement – your guide

- Statement – EU Services Directive

- This self-evaluation tool supports young people, adult, and older people services to assess how prepared they are for the Covid-19 pandemic (Key Question 7 from our quality frameworks) at the point of registration.

You can also visit The Hub, our ‘one-stop-shop’ website which has a wide range of resources aimed at supporting improvement in social care and social work by sharing intelligence and research-led practice.

What to expect from the registration process

You can now apply to register a care service online, using our new, secure system. The online application is simple to complete and only asks you questions that are relevant to your service type.

You can manage your application easily. You can save it as you go and return to it later so you can complete and submit at your own pace. You can go back to previous stages to check, change and add to your application. The new application allows you to upload supporting documents and pay your application fee.

Read our Guidance for applicants on applying to register a care service and online registration application form - user guide before applying.

Fees

Care services must pay fees to be registered with us. The maximum limit is set by Scottish Ministers. The fees we collect contribute to our operating costs.

We charge a fee for registering a new service and an annual continuation fee. The annual continuation fee licenses a care service to operate.

All application fees are non-returnable.

To find out more about our fees click here.

Fire safety information

The Fire and Rescue Service may inspect your premises to confirm your compliance, or to enforce the legislation if necessary. Your application will not be concluded without a completed Fire Safety Checklist. Read our guidance notes for fire safety checklist.

You should complete the following documents and return them to relevant organisation when you are ready to do so. As the checklist is a declaration that everything is in place you may wish to wait until later in the process to do this e.g. if you are undergoing building works.

- Fire safety checklist - This should be completed and sent your local fire authority.

- Fire safety checklist confirmation - This acts as your confirmation to us that you have sent the checklist to the local fire authority. This should be completed and sent to us.

Membership of the PVG scheme and criminal records checks

You must pay an additional fee for the cost of a Protection of Vulnerable Groups (PVG) scheme record checks as appropriate. We will determine from your application who this will be applicable to and be in contact with you to provide the relevant disclosure documentation.

You can find out more about the fees for PVG applications on the Disclosure Scotland website.

The Care Inspectorate must be a counter signatory to your own scheme record, and as such we require you to progress your PVG application through us. Once we complete the first part of the PVG application, you’ll receive an email with a link to complete your section.

Please be aware that, in addition to the PVG check, the Care Inspectorate also run online searches of publicly available information. If we have concerns about the information we find, we may contact Police Scotland.

Registering with Disclosure Scotland

For you to countersign PVG or disclosure checks for your staff or volunteers, you must be registered with Disclosure Scotland. You can find out how to register with Disclosure Scotland on their website. You will have a number of responsibilities after your register, including:

- following Disclosure Scotland's Code of Practice

- referring individuals to Disclosure Scotland when harmful or potential harmful behaviour and you dismiss the person as a result (or would or might have done had they not otherwise left).

You can also use an umbrella body to countersign PVG or disclosure checks on behalf of your organisation. A list of umbrella bodies is available on the Disclosure Scotland website.

Contact Disclosure Scotland if you need help:

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

Phone: 0300 020 0040

Monday to Thursday: 9am to 4pm

Friday: 9am to 3:30pm

What happens next?

Once we have received your completed application and all the documentation we have asked you for, and you have paid the fee, we will contact you. We aim to assess applications for a childminding service within three months and all other services within six months. However, this presumes that you supply us with a competent and fully detailed application, as well as any additional information we request. It is in your interest to give us all the information we ask for in the application form to prevent any delays or the risk of us closing or refusing your application.

Once you have submitted your application, our national registration team will check:

- that the information you give us in the application form is correct

- that the correct fee has been paid

- whether you are fit to provide and manage the service

- if your premises (where the service is to be provided) are fit to be used for that purpose

- that the proposed service will make all the proper provisions for the health, welfare, independence, choice, privacy and dignity of everyone using the service.

We may also check the financial viability of the service. Any information we ask for during this process is in accordance with the Public Services Reform (Scotland) Act 2010.

Successful registration

If your registration is successful, we will confirm this and provide you with a certificate of registration (electronically via our eForm portal), detailing the conditions of registration. You should print the certificate and display it so that anyone who uses your service can read it. The conditions of registration are also available on our care service list.

You will also see a list of records that you must keep and a list of notifications that you must make to the Care Inspectorate within our eForms portal. See our guidance on records that all registered care services (except childminding) must keep and guidance on notification reporting.

Decisions on an application to register a service

Following an application for registration, under Section 59(1) of the Public Services Reform (Scotland) Act 2010 ("the Act"), the Care Inspectorate can in terms of s 60(1):

- grant the application unconditionally, s60(1)

- grant the application subject to conditions, s60(2)

- refuse the application, s60(1).

If we propose to refuse your registration, or to grant registration subject to conditions that have not been agreed in writing, we must give you notice of our proposal to do so. Such a notice, where sent by post, is deemed (by section 101 of the Act) to be received on the third day after the day it was posted.

If you wish to dispute any matters, you must do this in writing within 14 days. The notice of proposal will state where these must be addressed to.

If we propose to refuse registration, or to grant registration subject to conditions that have not been agreed in writing, you have a right of appeal to the sheriff. This right is set out at section 75 of the Act. Any appeal must be made within 14 days (17 days if we have sent this in the post).

Create an account to begin your application

Sign in to see an existing application

If you need the application form in an alternative format, please call our contact centre on 0345 600 9527.

Read more